-

- Home

- News

- Providers

Vodafone Oman

Vodafone Oman Emirates Telecom

Emirates Telecom  Ooredoo Om

Ooredoo Om Ooredoo Qa

Ooredoo Qa stc Bahrain

stc Bahrain Orange Egypt

Orange Egypt Mobily

Mobily Zain Jo

Zain Jo omantel

omantel STC

STC Emirates Du

Emirates Du Asiacell

Asiacell Etisalat Egypt

Etisalat Egypt  Telecom Egypt

Telecom Egypt jawwal

jawwal Orange Jo

Orange Jo Umniah

Umniah Zain Sa

Zain Sa Bahrain Batelco

Bahrain Batelco Zain Bh

Zain Bh Wataniya palestine

Wataniya palestine Kuwait Viva

Kuwait Viva  Zain Kw

Zain Kw Vodafone Qa

Vodafone Qa MTN Syria

MTN Syria Syriatel

Syriatel Sabafon

Sabafon Zain Iq

Zain Iq MTN Yemen

MTN Yemen Ooredoo Kw

Ooredoo Kw Vodafone Egypt

Vodafone Egypt  Samatel

Samatel

- Phones

Huawei

Huawei Samsung

Samsung MOTOROLA

MOTOROLA Lenovo

Lenovo Alcatel

Alcatel LG

LG Nokia

Nokia Sony Ericsson

Sony Ericsson HTC

HTC BlackBerry

BlackBerry Siemens

Siemens Acer

Acer Sony

Sony Asus

Asus VK

VK APPLE

APPLE BenQ-Siemens

BenQ-Siemens Sagem

Sagem Eten

Eten HP

HP Panasonic

Panasonic Amoi

Amoi Toshiba

Toshiba Sharp

Sharp Sonim

Sonim Bird

Bird Mitac

Mitac Philips

Philips Vertu

Vertu Pantech

Pantech Micromax

Micromax Maxon

Maxon Haier

Haier I-mate

I-mate Gigabyte

Gigabyte I-mobile

I-mobile Kyocera

Kyocera BenQ

BenQ Microsoft

Microsoft Telit

Telit Connect

Connect Sendo

Sendo Mitsubishi

Mitsubishi SEWON

SEWON NEC

NEC DELL

DELL Thuraya

Thuraya Neonode

Neonode Be

Be Qtek

Qtek Bosch

Bosch Palm

Palm MWG

MWG Fujitsu Siemens

Fujitsu Siemens XCute

XCute WND

WND INQ

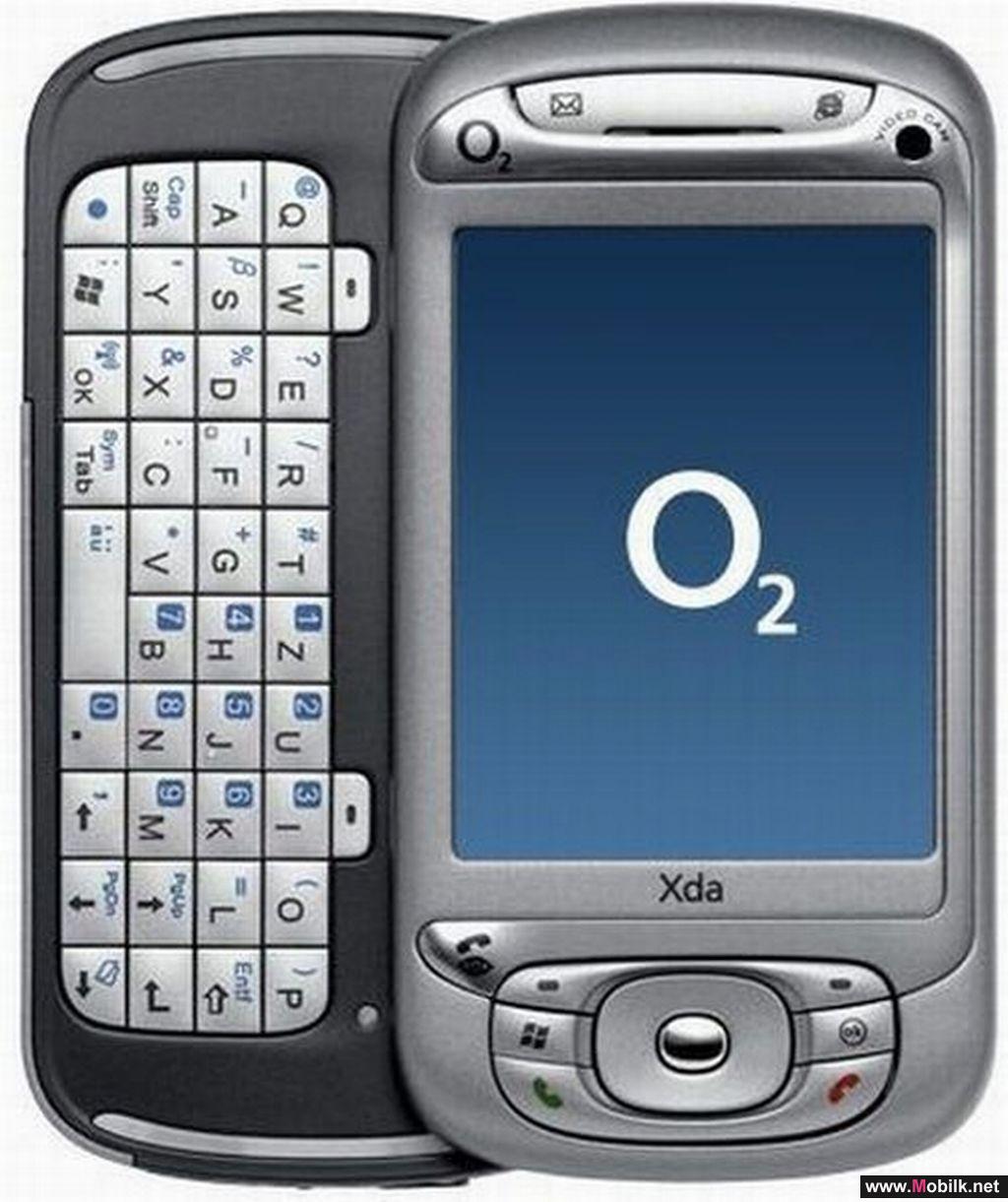

INQ O2

O2 Innostream

Innostream Benefon

Benefon Google

Google

- Tablets

- Compare Cell Phones

- AI tools directory

- About us

- Ooredoo and Oman Chamber of Commerce Sign Landmark MoU to Drive Business Growth..

- Empowered & Unstoppable: Springboard and SpringForward Graduates Take Centre..

- Ooredoo Bags Bronze for Tech Excellence at 2024 Stevie® Awards..

- Ooredoo and Tech Mahindra Strengthen Partnership to Excel in Digital Customer..

- Ooredoo Wins Big in The Telecom Category at The COMEX Excellence in Technology..

- Get A Fancy New Number While Giving Back with Ooredoo’s Vanity Number Auction..

- TRA Report Reveals Premium Download Speeds in Qurayyat and Al Amerat on..

- Ooredoo Continues to Give Back to Communities Across Oman During Second Part of..

- Stand Out from The Crowd and Give to Charity at The Same Time with The Ooredoo..

- stc Group Sponsors and Participates in the Prestigious Mobile World Congress in..

Mobilk.net offered in

العربية